The newest financing conditions to own an excellent jumbo mortgage are a lot much harder to satisfy than simply an elementary, compliant mortgage. These types of same standards use if you are looking to refinance the jumbo financing. In case interest rates was low adequate, refinancing will save borrowers who took on large fund somewhat good bit of currency. Before you begin obtaining good refi, even if, make sure to follow the following suggestions. These are typically examining your credit score, getting the economic documents working and you may learning just how payday loans in Goshen AL far refinancing could save you.

Refinancing is a major economic circulate, therefore consult an economic coach to see the way it you will definitely apply at your enough time-term financial plans.

Suggestion #1: Estimate Just how much Refinancing Could save you

Don’t neglect to look at the split-also several months, or even the point at which you earn right back the expense out of refinancing using your focus savings. When you have an excellent jumbo mortgage, even a portion of a positive change on your own interest normally features a critical impact on your a lot of time-term savings.

Suggestion #2: Choose If or not You’ll Cash out People Value

With home prices rising, many jumbo financing holders are utilizing an effective re-finance once the the opportunity to utilize a few of the collateral they’ve got centered. If you like extra money to invest in a property recovery or combine personal debt, you can test to acquire more income by way of a money-aside refinance.

No matter if you’re not browsing would a cash-away re-finance, it’s best to learn exactly how much equity you have. When you have most family guarantee, it will be far easier in order to persuade the lender to lead you to re-finance their jumbo financing. In most cases, you need to have about 20% collateral in your home upfront addressing lenders regarding the an effective the fresh new loan.

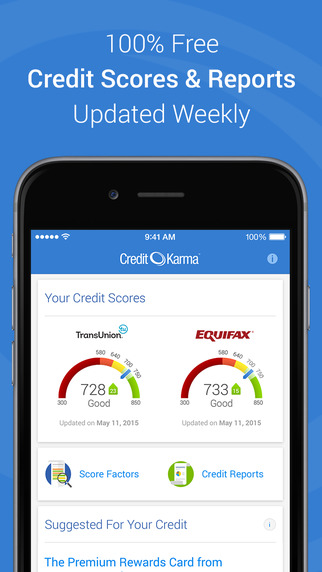

Tip #3: Check your Credit history Current Background

Refinancing people home mortgage involves a credit score and records look at. While it comes to refinancing jumbo money, lenders require how good another person’s credit score is.

It is because you will find always additional money at risk. Along with, jumbo loans aren’t backed by Federal national mortgage association and you can Freddie Mac, because they’re larger than the latest compliant mortgage constraints set by brand new Government Homes Funds Service (FHFA). Versus this support, lenders might possibly be to your hook up for your mortgages one standard.

Not just does your credit score connect with whether you could potentially re-finance your own jumbo financing but it addittionally possess an effect on new brand of rates your qualify for. It’s best to work at driving their FICO rating beyond the 700-mark if you’d like access to by far the most beneficial words.

Suggestion #4: Get your Paperwork managed

Underwriting guidelines having jumbo fund have become far more stringent since the property collapse. That implies you will have to have the ability to their documents in check if you need an attempt from the refinancing their financial. That’s why it is preferable to have some time to gather your pay stubs for the past 2 to 3 weeks, your taxation statements regarding prior 2 yrs plus bank comments in the earlier in the day six months.

Whenever you are notice-functioning, be ready to render a copy of a profit and you can losses report, and references to verify the a job updates when you are operating just like the a separate contractor.

Tip #5: Very carefully Look Latest Re-finance Rates

Before you can refinance people mortgage, it is very important examine prices regarding more lenders. By doing this you should have a concept of what you are able to be eligible for. Looking around might also make you an opportunity to negotiate terms and conditions if you find a lender we would like to work on.

Except that haggling your path so you can a better rate, it is best to try and get a package towards the your closing costs since they will add several thousand dollars so you’re able to the cost of the refinance.

Realization

Refinancing would-be a life saver getting homebuyers whom had good jumbo mortgage at once when financial cost was in fact bad. But simply including obtaining a beneficial jumbo loan, the method for refinancing is hard and you can littered with strict criteria. Therefore its vital that you get finances and you will paperwork from inside the purchase before you even begin implementing.